Federal Reserve

View:

May 20, 2024

FOMC Minutes from May 1 to Suggest Restrictive for Longer

May 20, 2024 7:15 PM UTC

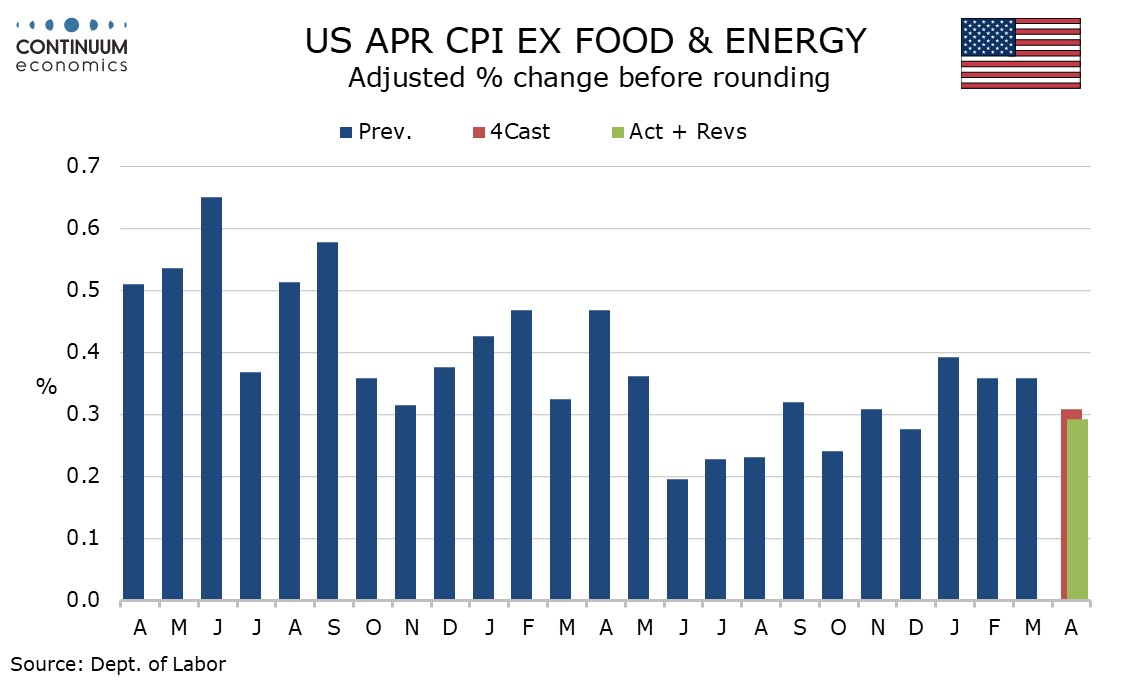

FOMC minutes from May 1 are due on May 22. The minutes are likely to be a more hawkish than those from the March 20 meeting released on April 10, given the strength of data released between the two meetings. Restrictive policy for longer so likely to be the message, but with no clear timetable. Soft

May 16, 2024

May 14, 2024

May 13, 2024

May 10, 2024

May 06, 2024

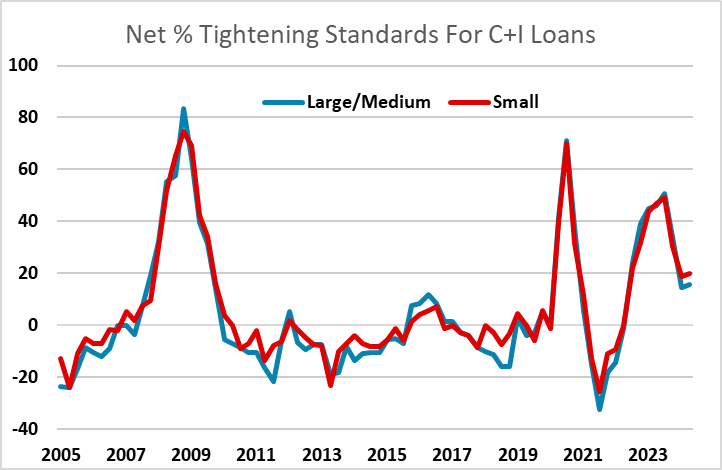

Fed SLOOS on Bank Lending mostly resilient

May 6, 2024 6:27 PM UTC

The Fed’s Q2 Senior Loan Officer Opinion Survey on bank lending practices generally sustains a less negative tone seen in the last survey for Q1, and does not suggest that the Fed need to have any serious concerns about the business investment outlook.

May 03, 2024

May 01, 2024

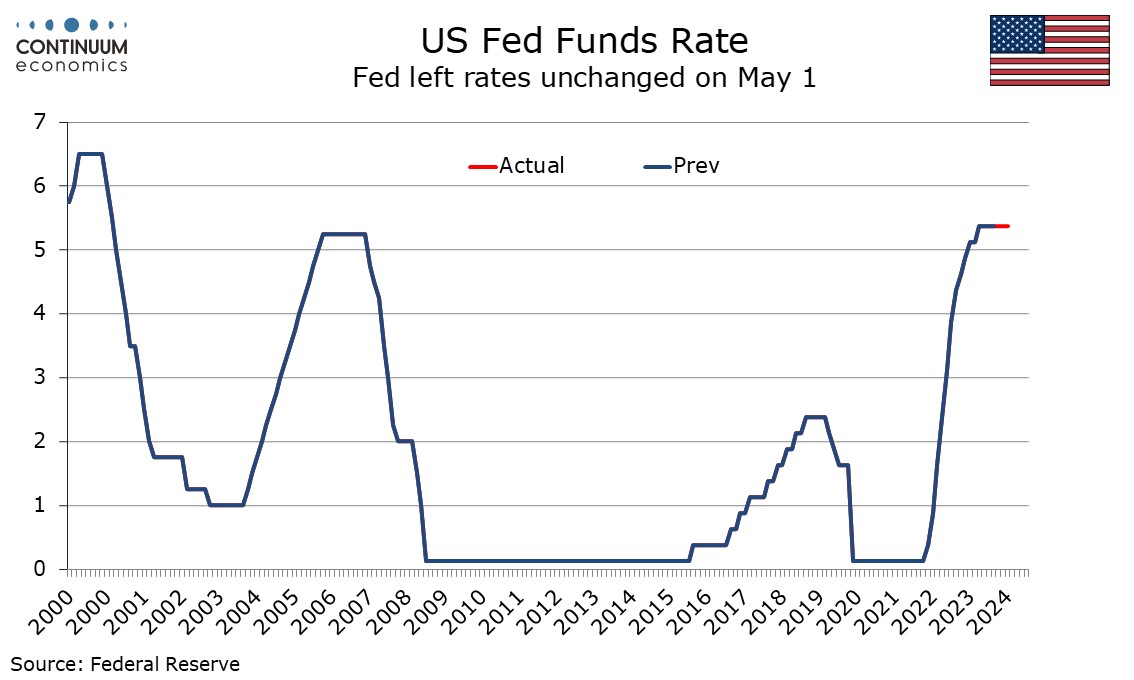

FOMC Still Waiting For Data to Justify Easing

May 1, 2024 7:58 PM UTC

The May 1 FOMC statement, and Chairman Jerome Powell’s press conference, while noting recent inflation disappointment, did not deliver a strong pivot in tone. The Fed is still waiting for data to allow easing to take place, but still expects inflation to slow, and looks ready to respond once data

April 25, 2024

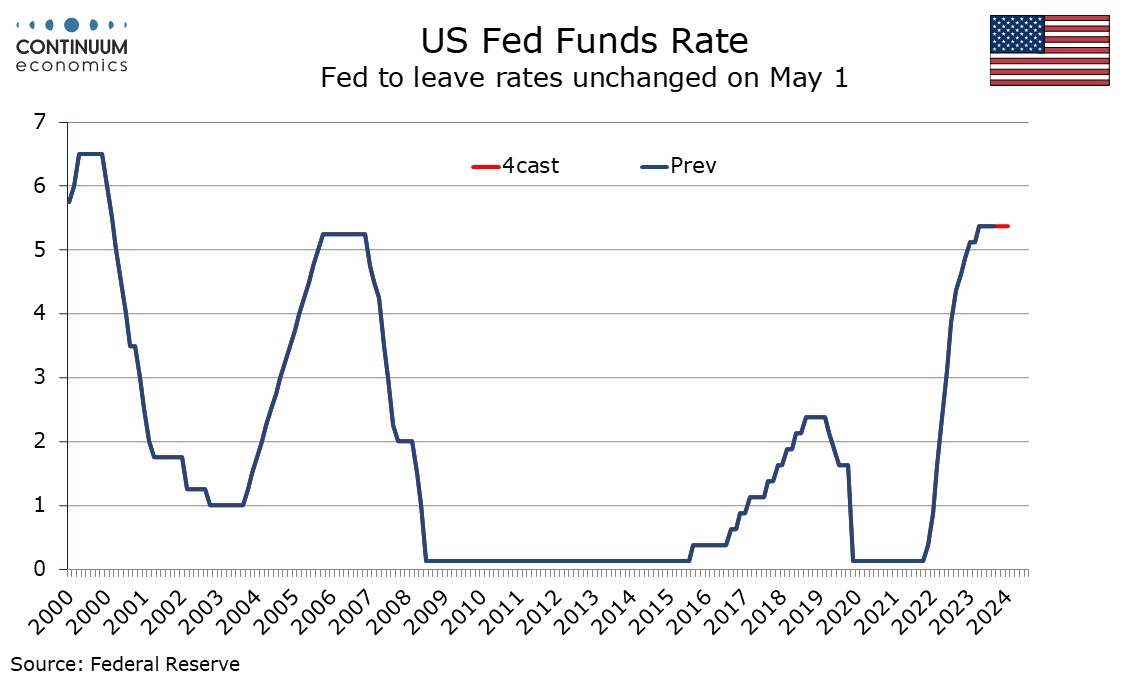

FOMC Preview For May 1: Signaling Concern on Inflation, Tapering Quantitative Tightening

April 25, 2024 7:04 PM UTC

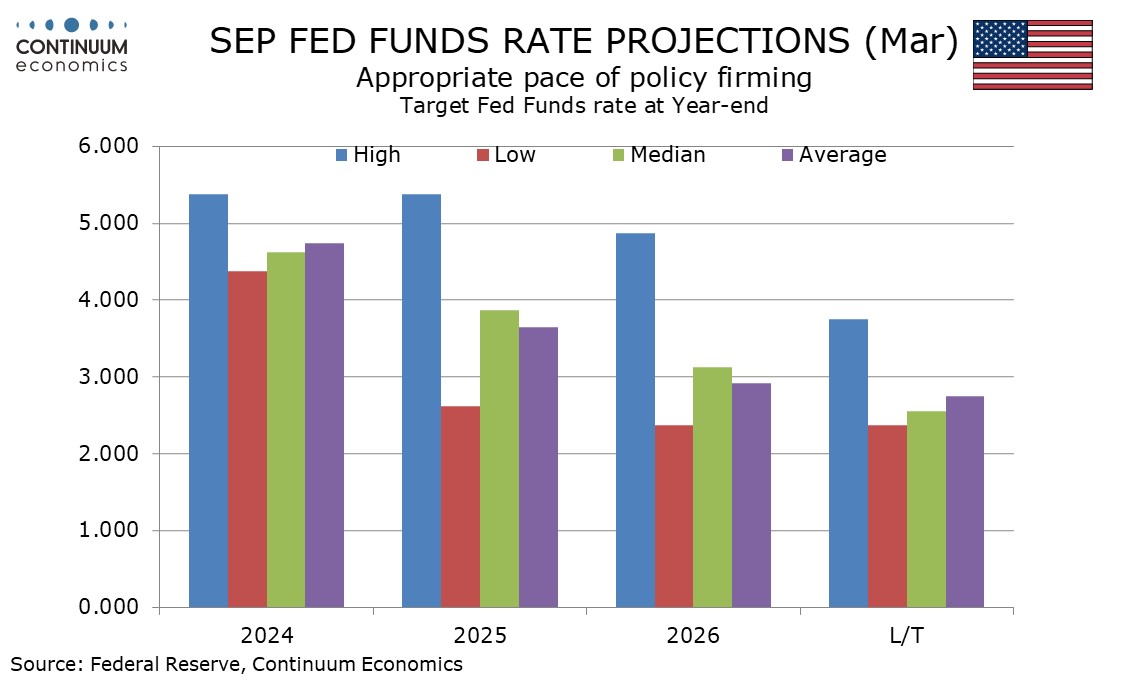

Bottom Line: The FOMC meets on May 1 and rates look sure to remain at the current 5.25%-5.50% target range. The statement is likely to see some adjustments to reflect recent disappointment on inflation while repeating that more confidence on inflation moving towards target is needed before easing. I

April 22, 2024

Short-end European Government Bonds Following U.S. But June Decoupling

April 22, 2024 1:15 PM UTC

The Fed’s shift to higher for longer has spilled over to drag European government bond yields higher through April. This now looks overdone as a June ECB rate cut is not fully discounted and ECB officials/data clearly point towards a 25bps cut. UK money markets are more out of line, with a Jun

April 19, 2024

April 18, 2024

April 17, 2024

April 16, 2024

April 12, 2024

April 11, 2024

April 10, 2024

Tone of FOMC Minutes From March 20 is Not Hawkish

April 10, 2024 6:54 PM UTC

FOMC minutes from March show little sign of disagreement and the tone is not hawkish, with participants expecting both inflation and the economy to slow, and there being a clear majority view that the pace of balance sheet reduction should soon be trimmed. Optimism on inflation is however cautious

April 05, 2024

April 04, 2024

Could FOMC Minutes From March 20 Appear More Hawkish Than Powell?

April 4, 2024 6:55 PM UTC

FOMC minutes from March 20 are due on April 10. Powell’s press conference at that meeting and his subsequent comments have been relatively dovish, downplaying recent strong data though he has also sounded in no hurry to ease. The minutes may show a significant minority expressing greater concern