People's Bank of China

View:

May 17, 2024

May 15, 2024

China: Too Much Debt In Some Sectors

May 15, 2024 9:55 AM UTC

While part of corporate debt is quasi government (SOE and LGFV’s) and China creditors can be pursued to rollover by the authorities for larger borrowers, households and part of the private sector are focused on the previous buildup of debt. With China authorities reluctant to aggressive ease fis

May 13, 2024

China RRR and Rate Cuts

May 13, 2024 7:54 AM UTC

The latest China money supply and lending figures show that private household and business lending is very subdued. More need to be done to boost credit demand as well as credit supply. However, the authorities desires to avoid too much Yuan weakness will likely mean that the next move is a 25bp

May 08, 2024

China Equities: A Tactical Play

May 8, 2024 2:20 PM UTC

China equities can see a tactical bounce of 5-10% in the coming months. Cheap valuations and underweight global fund positions means that the scale of pessimism only has to get less bad on the economy and China authorities attitude towards businesses. While we see a tactical opportunity, we do

May 03, 2024

EMFX: Diverging On Domestic Forces Not Less Fed Easing Hopes

May 3, 2024 10:45 AM UTC

While U.S. economic developments, plus Fed policy prospects, will be important in terms of EM currency developments, domestic politics and fundamentals will also be decisive. These can keep the South Africa Rand volatile in the remainder of 2024, given the risk of a coalition government and African

May 02, 2024

China Politburo: Help for Housing, But No Game changers

May 2, 2024 10:50 AM UTC

Politburo statement in late April suggests extra support for residential property. However, we see this as being incremental rather than any game changers and we still see residential investment remaining a negative drag on 2024 GDP growth.

April 29, 2024

China: Depreciation Rather Than Devaluation

April 29, 2024 1:00 PM UTC

We feel that a devaluation of the Yuan is unlikely in 2024, both to avoid potentially politically destabilizing capital outflows but also to avoid upsetting the next U.S. president. Policy is geared more towards controlled depreciation to help competiveness but reduce other risks. The Yuan has a

April 16, 2024

China: Q1 Upside Surprise, but March Disappoints

April 16, 2024 8:33 AM UTC

Q1 GDP upside surprise was driven mainly by public sector investment. With the government still to implement the Yuan 1trn of special sovereign bonds for infrastructure spending, public investment will likely remain a key driving force. However, the breakdown of the March data show that retail s

March 20, 2024

China Outlook: The Struggle to Hit 5% Growth

March 20, 2024 11:00 AM UTC

China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means some of the old engines of growth are not firing. Some additional fiscal stimulus will likely

March 18, 2024

China: Unbalanced Growth

March 18, 2024 8:28 AM UTC

The February monthly data shows unbalanced growth. Industrial production and public investment picked up, but retail sales slowed and residential property remains a negative drag on GDP. While H1 GDP growth will be ok, it will likely slow in H2 and we still stick to a forecast of 4.4% for 2024 a

March 15, 2024

China: No PBOC MTF Cut and Protesting Low Government Bond Yields

March 15, 2024 8:51 AM UTC

Bottom Line: The PBOC decided not to cut the Medium-Term Facility (MTF) rate, but surprised by also withdrawing liquidity in what looks like a protest at the recent decline in government bond yields. A 10bps MTF cut should still arrive in Q2, but later rather than sooner.

March 11, 2024

China: Lunar New Year Boosts CPI, But Disinflation Still In Place

March 11, 2024 8:29 AM UTC

Bottom Line: February China CPI surged to +0.7% v -0.8% Yr/Yr due to three factors. The late lunar New Year boosted CPI seasonally, while the good lunar New Year also boosted pork/food prices and travel prices. The bounce is unlikely to be sustained and we see a fall back to 0.3-0.4% Yr/Yr in Ma

March 05, 2024

China: 5% 2024 Goal Tough with L Shaped Residential Property

March 5, 2024 9:43 AM UTC

Bottom Line: China’s 5% growth target will likely be tough to meet with residential property investment likely to knock 1.0-1.5% off GDP and net exports a small negative. With sluggish private investment, this means the old engines of growth are not firing. Some additionally fiscal stimulus will

March 04, 2024

Taiwan Speaker Reduces China/Taiwan War Risk

March 4, 2024 10:30 AM UTC

Bottom Line: Taiwan new speaker, Han Kuo Yu, has a willingness to open dialogue with China. This does not stop China likely undertaking large scale military exercises in the spring around Taiwan, as it still seeks to pressure the incoming DPP president. However, we see the new Taiwan speaker elect

February 28, 2024

China: Authorities Views and Policy Changes

February 28, 2024 10:15 AM UTC

Bottom Line: China authorities leave the impression that further policy stimulus will likely be measured rather than aggressive. We feel that they are not pessimistic enough on the medium-term hangover from the residential property sector and this is why we are downbeat on 2024 GDP growth and beyo

February 21, 2024

China: Yuan Outflow Fears Versus Net Exports

February 21, 2024 11:00 AM UTC

Despite a still overvalued Yuan, China authorities are reluctant to accept too much Yuan weakness for fear of causing domestic capital outflows and discontent with China’s government. At some stage, if GDP growth surprises on the downside, China authorities could decide that a controlled Yuan decl

February 20, 2024

China: 5yr LPR Cut But Not 1yr LPR

February 20, 2024 9:17 AM UTC

A larger than expected 25bps cut in the 5yr Loan Prime Rate (LPR) has been delivered, but the 1yr LPR rate was unchanged given that PBOC reluctance to cut the 1yr Medium-Term Facility rate (MTF) this month. The 5yr LPR rate is not a game changer for residential property, as bigger policy moves are

February 13, 2024

China: 5% or 4.5-5.0% Growth Target

February 13, 2024 10:34 AM UTC

Though economics would argue for a 4.5-5.0% growth target for 2024, politics will likely mean that a 5% growth target is chosen in March. With the residential property overhang, weak net exports with a shift of global supply chains and sluggish private sector business investment growth, this will

January 17, 2024

China: GDP 5.2% for 2023, but 2024 To Struggle

January 17, 2024 9:24 AM UTC

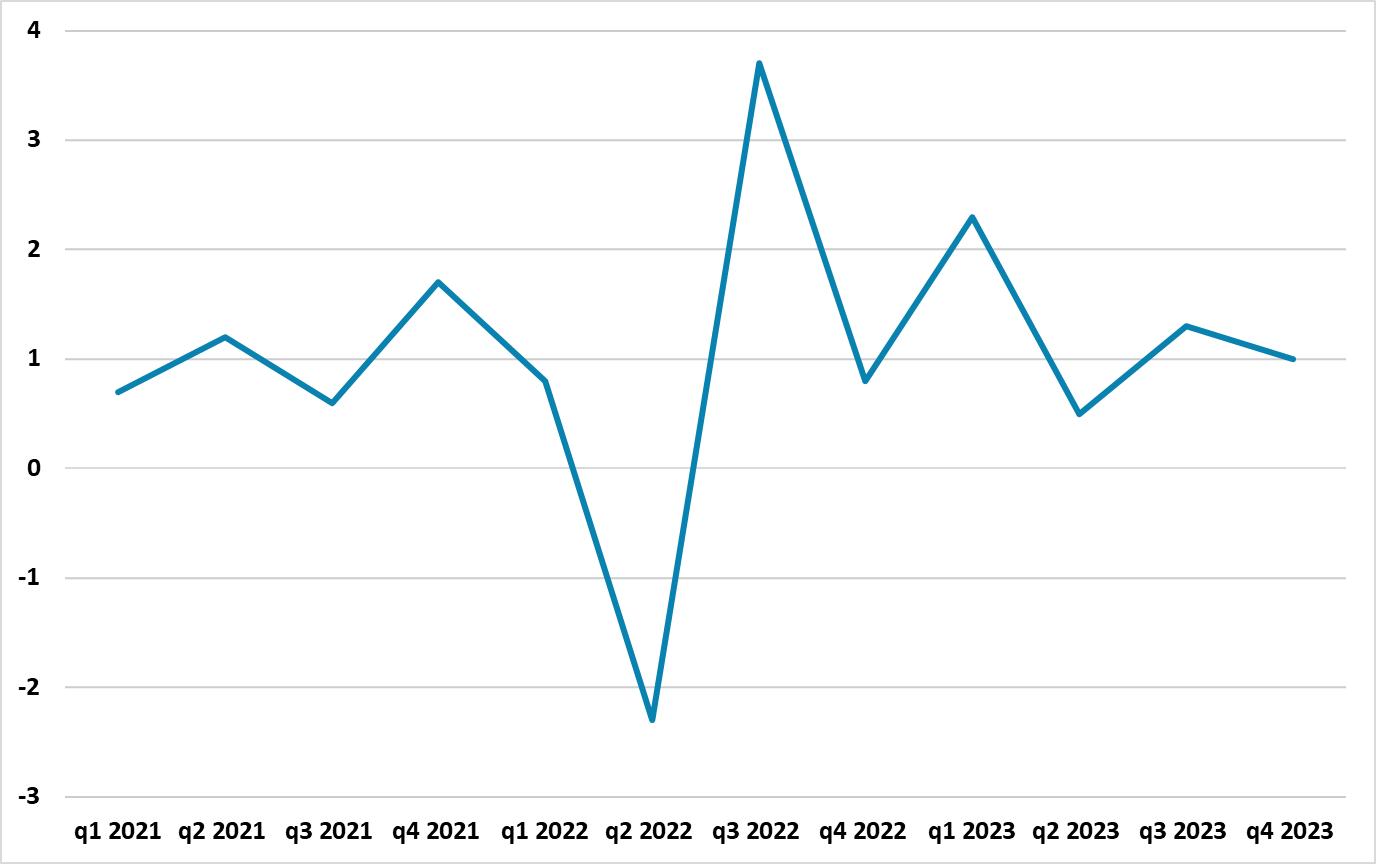

Quarterly GDP is interesting and came in at 1.0% after the 1.3% quarterly gain in Q3. The trend in quarterly GDP (Figure 1) is also not consistent with 5% growth and the Yr/Yr will dip in Q1 2024 when the large gain in Q1 2023 drops out (due to the end of zero COVID policies). We maintain the 4.

January 12, 2024

China: January MTF and March RRR Cut?

January 12, 2024 9:25 AM UTC

Figure 1: China RRR (%)Source: Datastream/Continuum Economics

A senior PBOC official has hinted at an RRR cut on Tuesday (here), given the desire to sustain credit growth. Similar comments were evident last July before the RRR cut in September. We would argue that further monetary easing is l

January 05, 2024

China: Five Headwinds To Long Term Growth

January 5, 2024 9:00 AM UTC

The catch-up productivity argument would point towards 4-5% growth in China in the 2025-2030 period. However, we are concerned that the residential property downturn and rewiring of global supply chains will be persistent headwinds for China GDP growth in the coming years and that the adverse popu

December 27, 2023

USD Reserve Status: Slow Slippage

December 27, 2023 1:23 PM UTC

Figure 1: Pct of USD in Allocated FX Reserves

Source: IMF COFER/Continuum Economics

The latest IMF COFER data (here) shows that the USD still remain the dominant currency among central banks, with the Euro in 2nd place at 19.6% followed by the Japanese Yen and British Pound. The Chinese Yuan i

December 15, 2023

China Outlook: Headwinds To Growth

December 15, 2023 10:06 AM UTC

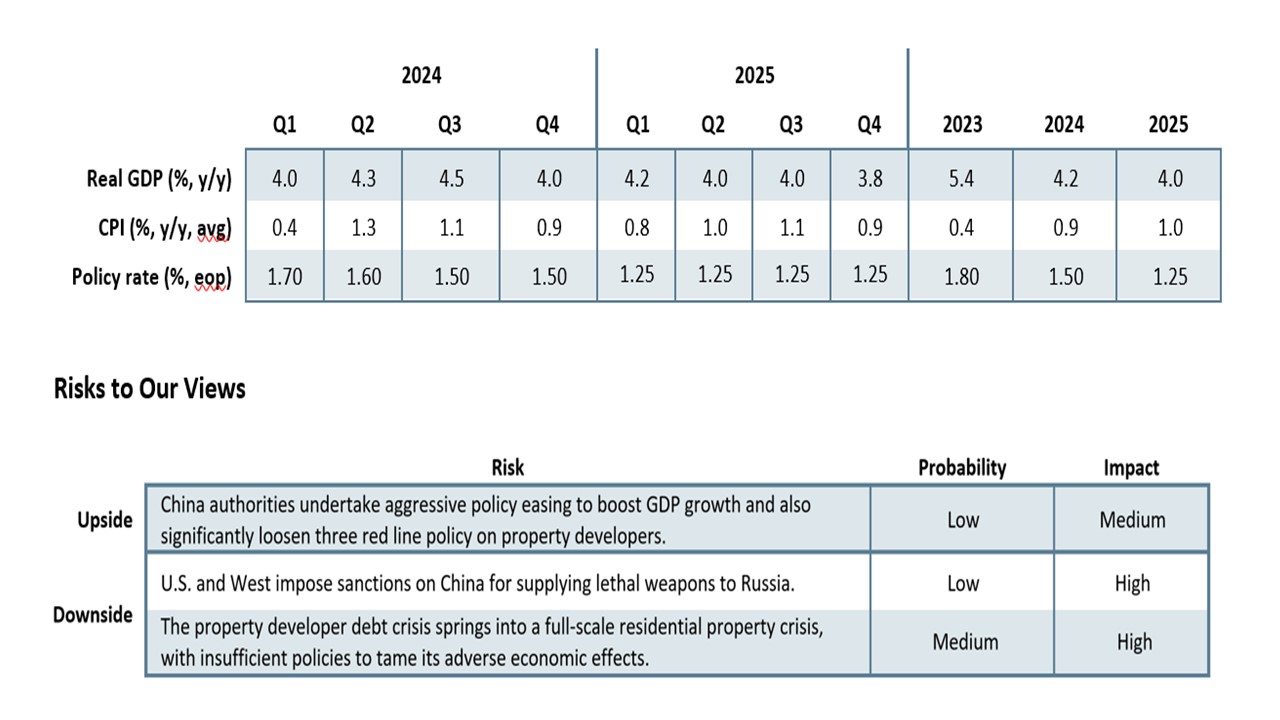

Our Forecasts

Source: Continuum Economics

Policy Stimulus Insufficient to Stop Slowing

China is facing a number of headwinds that will make 5% growth difficult to achieve in 2024. Key issues include:

· Property construction downturn. China authorities have undertaken

China Data: Retail Sales and Industrial Production Diverge, but No PBOC Cut

December 15, 2023 7:48 AM UTC

Figure 1: China Retail Sales Yr/Yr (%)

Source: Datastream/Continuum Economics

November data from China shows a mixed picture. Industrial production rose +0.9% on the month, while the Yr/Yr at 6.6% compared to expectations of 5.7% (the Yr/Yr is distorted upwards by the last phase of COVID lockd

November 28, 2023

Do China Want Strong Yuan?

November 28, 2023 12:01 AM UTC

On the chart, USD/CNH has turned up from the 7.1285 low to consolidate sharp losses from the November high. Consolidation around the 7.1500 level tracing out a bear flag and see risk for break of the 7.1285 low to further extend losses from the Sep high to retrace gains from the January low. Break w

November 22, 2023

Chinese Yuan Bounce Overdone

November 22, 2023 12:56 PM UTC

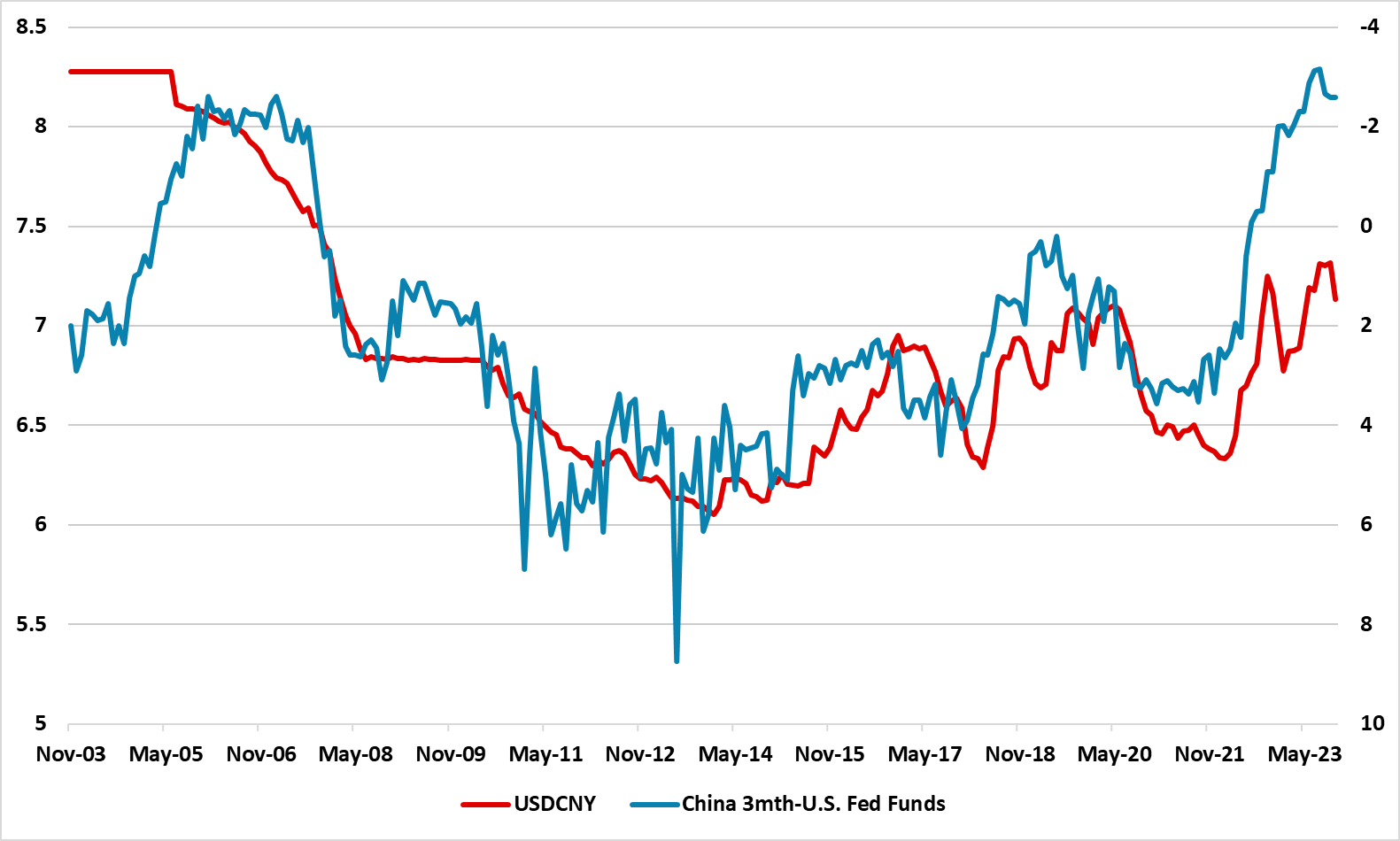

The CNY recent rally against the USD is largely driven by the softer tone of the USD across the board. However, interest rate differentials will likely remain at current wides until Q3 2024 and will then only narrow slowly. Meanwhile, foreign investors continue to liquidate China assets on conce

November 15, 2023

China Data Mixed, but No PBOC Cut

November 15, 2023 8:51 AM UTC

Figure 1: China Economic Surprise Index

Source: Datastream/Citibank

October data from China shows a mixed picture. Yr/Yr Industrial production and retail sales were slightly stronger than expected at 4.6% and 7.6% respectively. However, on the month industrial production grew 0.4% and retail sales a m

November 13, 2023

China: Five Headwinds To Long Term Growth

November 13, 2023 8:15 AM UTC

Concerns about long-term growth in China into the 2nd half of the decade are increasing, which is a concern for global growth given China's contribution to global GDP over the past 20 years.

Figure 1: China GDP Growth Forecasts to 2030 (%)

Source: Continuum Economics

China's Long-Term Growth Problem

November 09, 2023

China CPI and November/December Easing?

November 9, 2023 7:30 AM UTC

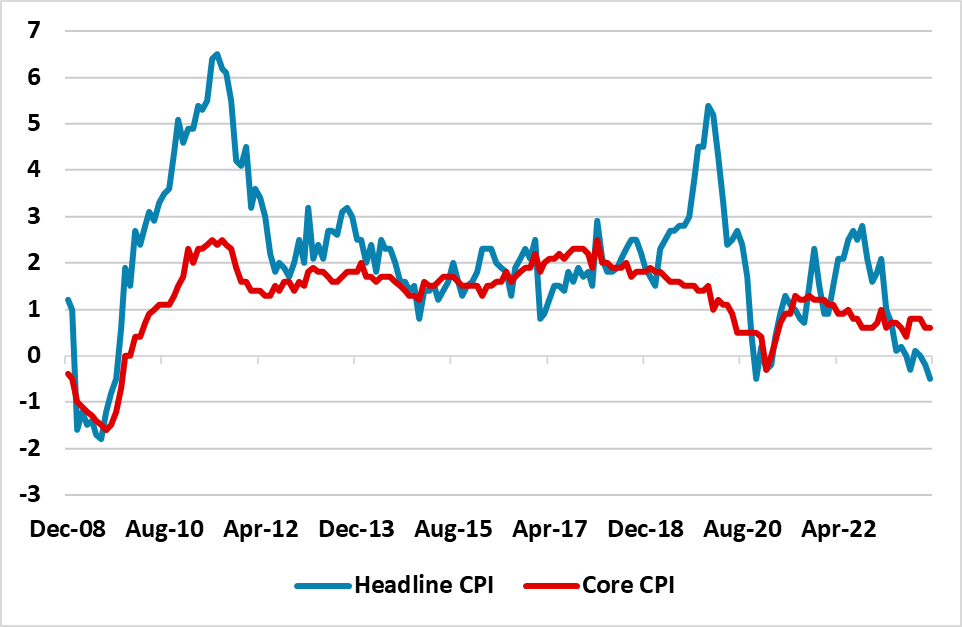

Figure 1: China Headline and Core CPI inflation

Source: Datastream

Pork prices helped to drag the headline inflation down, as excess pig production continues to be evident in the farming sector. Core CPI inflation at 0.6% remains a better indication of the underlying inflation momentum, which arg

October 30, 2023

Taiwan: Gray Warfare, Rather than Blockade/ Invasion

October 30, 2023 8:18 AM UTC

With the Taiwan election in January expected to re-elect the anti-China DPP, and the U.S. focused on Ukraine and Middle East, how will the Taiwan situation develop before and after the election and in the coming years?

Figure 1: Taiwan Scenarios for the Next 5 Years

Source: Continuum Economics

Mo

October 25, 2023

China Fiscal Easing To Under Pin 2024 Growth

October 25, 2023 10:50 AM UTC

Figure 1: China Primary and Overall Budget Deficit/GDP (%)

Source: IMF/Continuum Economics

The Yuan1trn increase in the 2023 budget deficit is to be channelled to increased local government spending on infrastructure including disaster reconstruction and prevention. Though officially the target is

October 18, 2023

China Q3 GDP Surprise, But Momentum Mixed

October 18, 2023 7:18 AM UTC

Figure 1: China GDP Yr/Yr (%)

Source: Datastream/Continuum Economics

The Q3 quarterly change at 1.3% is better than the 0.9% rise expected and keeps the Yr/Yr rate from falling too far (Figure 1). With Q4 2022 having been mixed, even a weak Q4 quarterly change should now ensure that the authorities

October 13, 2023

China: CPI Sluggish But Fiscal Policy Rather Rate Cut Next?

October 13, 2023 7:53 AM UTC

Figure 1: China Headline and Core CPI (%)

Source: Datastream/Continuum Economics

Fiscal Policy Stimulus

The September headline CPI came in lower than expected at zero Yr/Yr, as food prices dragged on the index – food supplies were plentiful ahead of golden week. The core inflation rate remai

September 26, 2023

China Outlook: Slowdown, As Policy Stimulus Not Enough

September 26, 2023 10:08 AM UTC

Our Forecasts

Source: Continuum Economics

Policy Stimulus Insufficient to Stop Slowing

Our GDP forecast looks for a slowing to 4.0% in 2024 from 4.8% in 2023 for a number of reasons.

Figure 1: Cumulative YTD Million Square Meters Residential Real Estate Development Versus Investment in Real Estate De

September 15, 2023

China: August Data Stabilises but More Q4 PBOC Easing To Come

September 15, 2023 6:40 AM UTC

Figure 1: Residential Property Investment YTD (%)

Source: Datastream/Continuum Economics

August Data Some Stability, But

The good news is that August retail sales (4.6% Yr/Yr v 3.0% expected) and industrial production (4.5% Yr/Yr v 3.9% expected) were better than expected and show stabilisation i

August 21, 2023

China: 1yr LPR Cut Only and RRR Next Given Yuan Concerns

August 21, 2023 6:42 AM UTC

Figure 1: RRR for Big Banks (%)

Source: Datastream/Continuum Economics

RRR Cut Next Step

Double disappointment on the LPR with a 10bps rather than 15bps cut on the 1 year LPR and no change for the 5yr rate. The latter has the market puzzled, given last week’s 15bps reduction in the PBOC medium-

August 18, 2023

Financial Markets: U.S. (Still) More Important Than China For Now

August 18, 2023 7:31 AM UTC

Markets are focused on China credit tensions, as well as the ongoing DM rate tightening story centred on the U.S. What will be most important into the autumn?

Market Implications: U.S. equities are out of line with the rise in bond yields and we see still see a correction for the S&P500 to 4200 by en

August 16, 2023

August 15, 2023

China: MTF Cut Arrives Early, But More Rescues and Stimulus Needed

August 15, 2023 8:03 AM UTC

Figure 1: 1yr PBOC MTF Rate (%)

Source: Datastream/Continuum Economics

July data shows a weaker than expected profile for the economy. Yr/Yr retail sales at +2.5%, YTD Yr/Yr slowing to 7.3% versus 8.2% in June, plus a stalling of monthly growth in retail sales show that consumer momentum is runni

August 14, 2023

China Property Crisis Spreads to Markets: Waiting for A Rescue

August 14, 2023 12:23 PM UTC

Reports that a major China property developer is looking to extend maturing Yuan bonds after missing USD bond payments last week, plus reports that a wealth management company has delayed paying clients, has caused new jitters about the property spill over into Chinese financial markets.

Market I

August 11, 2023

China LGFV Debt Swap: Good and Bad News

August 11, 2023 12:43 PM UTC

Figure 1: Local Government and Additional LGFV debt/GDP (%)

Source: IMF Article IV 2022 (here)

The details of the Yuan 1trn debt swap are still coming out, but news agencies suggest that it will be directed towards weakest LGFV’s in the troubled provinces including Guizhou, Hunan, Jilin, Anhui and

August 09, 2023

China: Negative Headline, But Breakdown Suggests Temporary

August 9, 2023 6:43 AM UTC

Figure 1: China Headline and Core Inflation (Yr/Yr %)

Source: Datastream/Continuum Economics

The breakdown of the July CPI data shows a contrast between headline inflation and a better underlying trajectory. Key points to note include

August 08, 2023

China Debt Pile: Hangover or Bust?

August 8, 2023 7:53 AM UTC

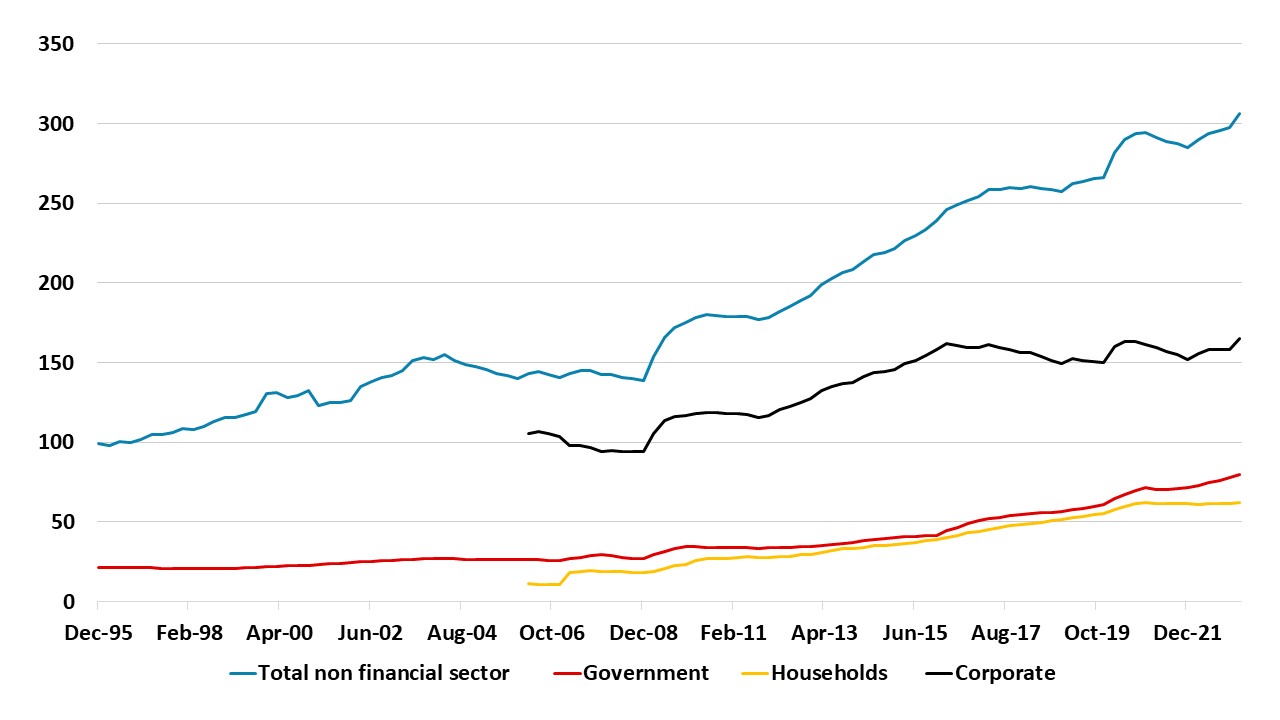

China has seen a large secular buildup of debt relative to GDP across government/corporate and household sectors since 2007 (here) and, in absolute terms, it has now exceeded the U.S. and EZ. Property developers and Local authority financing vehicles (LGFV) debt is now so large that managing the deb

July 24, 2023

China: Gradual Policy Steps Signalled

July 24, 2023 1:03 PM UTC

The July politburo statement today provides some clues to forthcoming policy easing in China. Key points to note.

Overall, we only see gradual policy easing and this is not enough to ensuring sufficient momentum to keep GDP growth above 5% in 2024. We maintain the view of 4.5% growth for 2024.

U.S. and China Strategic Competition and Consequences for EM Countries

July 24, 2023 7:22 AM UTC

Figure 1: China exports and Imports to the U.S. (USD Blns 12mth average)

Source: Datastream/Continuum Economics

The relationship between the U.S. and China has developed from the economic field to geopolitical security and competition, particularly in the last five years. President Trump’s focus w

July 17, 2023

China: Growth Momentum Slows

July 17, 2023 6:23 AM UTC

Figure 1: China GDP Yr/Yr (%)

Source: Continuum Economics/BIS

China growth momentum slowed in Q2 with a 0.8% rise on the quarter compared to the 2.2% quarterly gain in Q1.Though the Yr/Yr picked up to 6.3% from 4.5%, this is due to base effects with the Shanghai lockdown in Q2 2022 and the quarterly

July 14, 2023

China: Gradual and Measured Policy Easing Still

July 14, 2023 2:57 PM UTC

Figure 1: Total Non-Financial Sector Debt/GDP Since Q1 2007 (%)

Source: Continuum Economics/BIS

Chinese officials continues to signal that more policy support is coming, but the guidance still appears to be that this will be gradual. Deputy governor Liu Guoqiang of the PBOC on Friday cautioned again

July 10, 2023

June 20, 2023

China Outlook: Recovery To Fade Into 2024

June 20, 2023 8:10 AM UTC

Our Forecasts

China Two Speed Recovery

China economic recovery is a tale of two different contributions. Consumer services and tourism have shown a clear benefit from the shift to an endemic COVID policy and this could still have some momentum, both as consumer confidence rebuilds further and as con