Foreign Exchange

View:

May 17, 2024

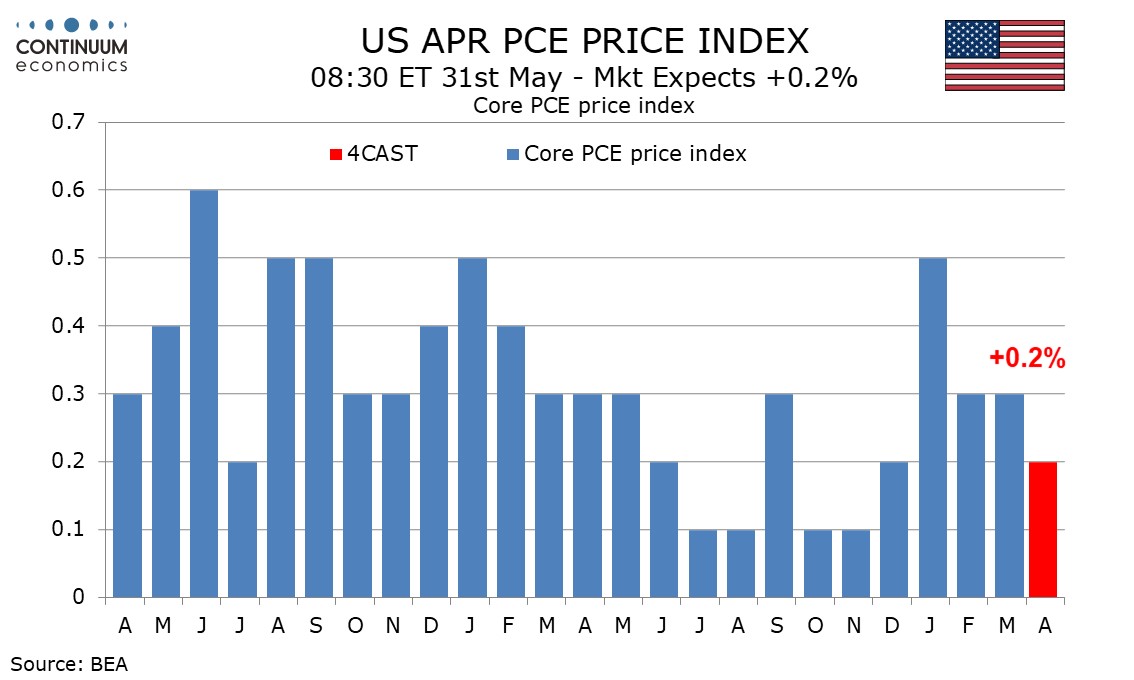

Preview: Due May 31 - U.S. April Personal Income and Spending - Core PCE Prices to round down to 0.2%

May 17, 2024 4:04 PM UTC

April’s core PCE price index looks set to come in close to 0.25% before rounding, though we expect the index to be rounded down to 0.2%, while overall PCE prices are rounded up to 0.3%. We expect a subdued 0.2% increase in personal income to underperform a 0.4% increase in personal spending.

Asia Open - Overnight Highlights

May 17, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as the greenback followed the post CPI drop initially before rebounding in the New York session. KRW saw the largest gains of 1.79%, followed by THB 1.09%, IDR 0.65%, TWD 0.61%, MYR 0.5%, PHP 0.12% and HKD 0.11%; the biggest losers are

May 16, 2024

U.S. April Industrial Production - Underlying picture looks flat

May 16, 2024 1:31 PM UTC

April industrial production was unchanged with a downward revision to March offset by an upward revision to February. Manufacturing was weak at -0.3% though outside a negative correction in autos the drop was only 0.1%, leaving a fairly flat underlying picture.

U.S. Initial Claims, Housing Starts, Philly Fed - No real surprises but consistent with a modest slowing

May 16, 2024 1:00 PM UTC

The latest data is all close to consensus, initial claims partially correcting a sharp rise last week, housing starts correcting a sharp fall last month but permits seeing a second straight dip while the Philly Fed corrected from a strong preceding month but remains positive. All this is consisten

May 15, 2024

Preview: Due May 16 - U.S. Apr Housing Starts and Permits - Housing sector losing momentum

May 15, 2024 2:02 PM UTC

We expect April housing starts to rise by 4.5% to 1380k after a 14.7% March decline while permits fall by 1.2% to 1450k after a 3.7% March decline. This would be consistent with the housing sector losing some momentum entering Q2 in response to rising mortgage rates in Q1.

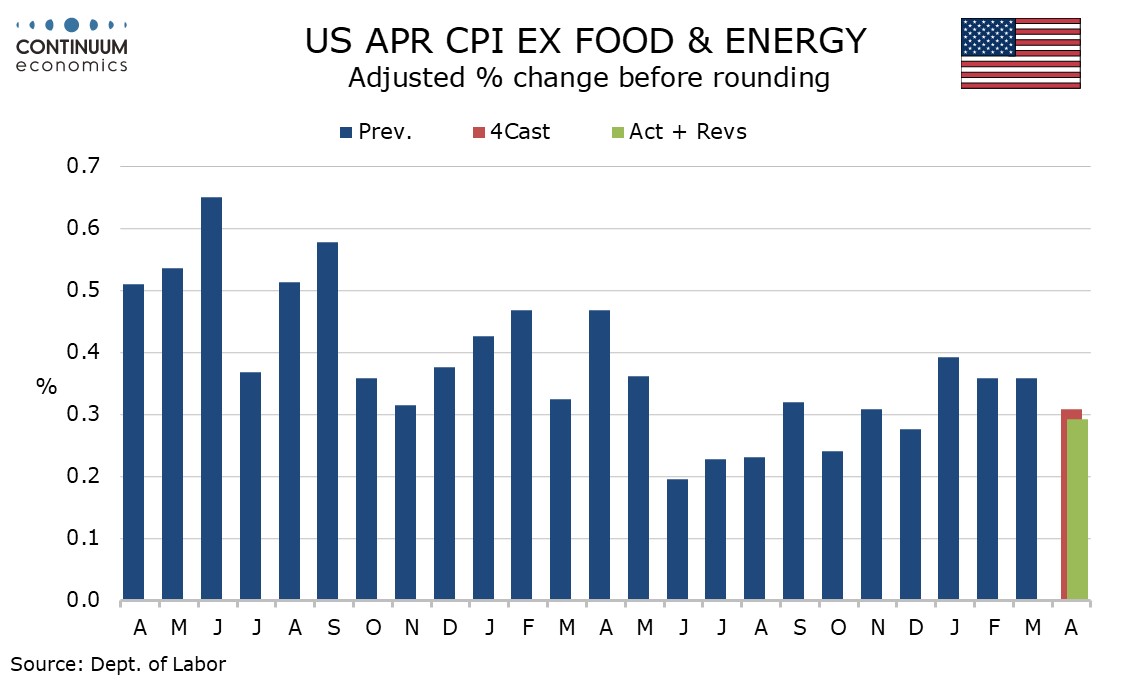

U.S. CPI and Retail Sales Show Some Loss of Momentum in April

May 15, 2024 1:14 PM UTC

April CPI has provided some relief by coming in lower than expected at 0.3% on the headline and while the 0.3% core is on consensus, it is on the soft side at 0.292% before rounding. Retail sales have also lost some momentum in April, unchanged overall, up 0.2% ex autos but down 0.1% ex autos and ga

Asia Open - Overnight Highlights

May 15, 2024 12:00 AM UTC

EMERGING ASIA

EM currencies perform individually against the USD as the greenback yo-yo on stronger PPI and Fed speaker's comment. THB saw the largest gains of 0.41%, followed by MYR 0.25%, SGD 0.13%, PHP 0.04% and INR 0.02%; the biggest losers are IDR 0.12%, KRW 0.07% and TWD 0.02%.

USD/CNH is tradin

May 14, 2024

Preview: Due May 24 - U.S. April Durable Goods Orders - Underlying trend remains near flat

May 14, 2024 6:01 PM UTC

We expect April durable goods orders to fall by 0.8% after a rise of 0.9% in March (after annual revisions were released on May 14) with a 0.3% increase ex transport to follow an unchanged March. Underlying trend remains close to flat.

Preview: Due May 22 - U.S. April Existing Home Sales - No signals for a strong move

May 14, 2024 3:29 PM UTC

We expect existing home sales to be unchanged at 4.19m in April, pausing after a 4.3% decline in March corrected a strong 9.5% increase in February. We expect to see trend move lower in the coming months, but there are no clear signals for a second straight decline in April.